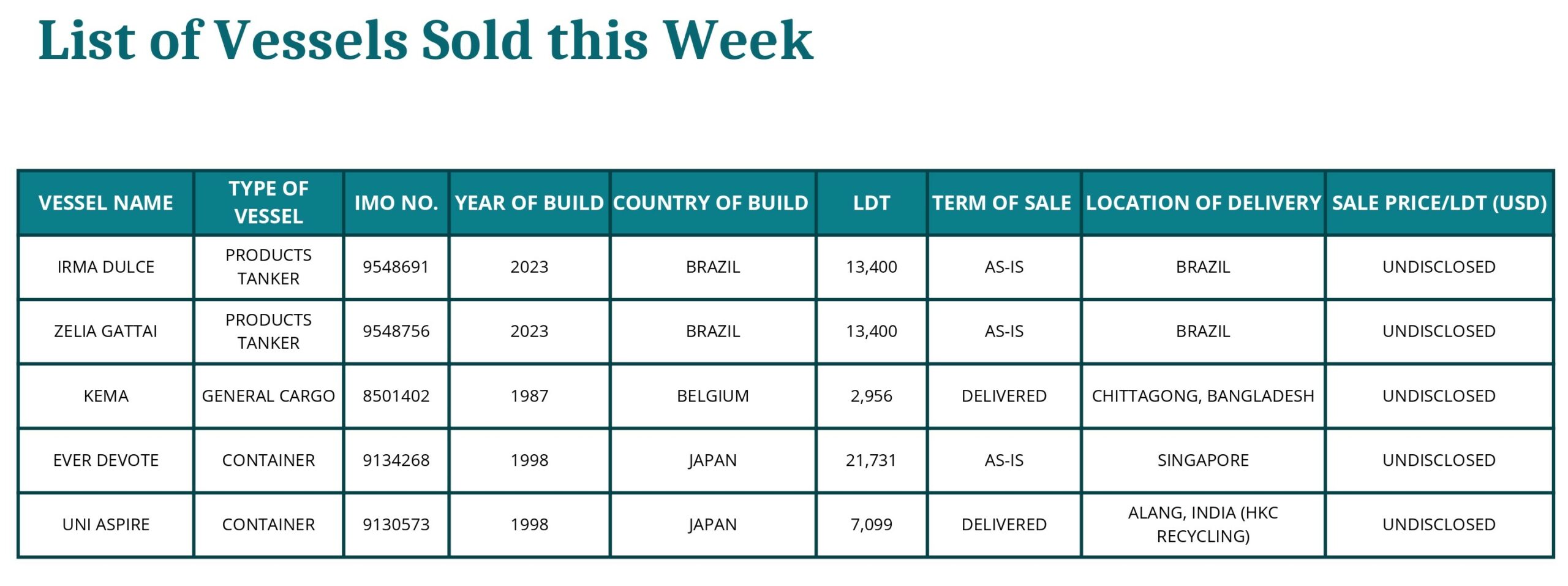

Highlights of the Week (Please read vessel sold during this week, at the bottom of this story)

The ship recycling industry appears to have gained momentum, with Indian ship recyclers emerging as the most dynamic participants. Meanwhile, Pakistan is making a comeback after a prolonged absence. It is worth noting that a substantial influx of vessels into the recycling market has sparked robust purchasing activity from the Indian subcontinent. While the purchasing enthusiasm in Bangladesh appears to be restrained due to the prolonged issues with its letter of credit, it seems that this situation will persist for some time. Turkey, which had been relatively inactive, appears to have recently experienced a humble increase in activity.

There are concerns regarding the potential fluctuation of China’s economic recovery, primarily attributed to the country’s pressing challenges, including a significant debt burden, a decline in the housing market, and a dearth of stimulus measures. Numerous nations, notably developing economies, have a strong correlation with commodity prices, alongside China, hence possessing the ability to influence global commodity prices. India, as an illustrative example, has lately taken proactive measures to address specific vulnerabilities in the global economy that have emerged due to the economic downturn experienced by China. This implies that China may no longer retain its dominant position in influencing commodity prices. Determining whether China’s economic recovery would provide sustained backing to steel plate pricing is a challenging task. Despite the current surge in local steel prices, China Steel Corp. has previously seen abrupt declines in pricing as well. Furthermore, it is worth noting that countries such as India and Mexico have shown notable advancements in the global steel trading industry. This implies that these countries may now hold an increased ability to influence global steel pricing and demand.

Why Hong Kong Convention in ship recycling is necessary?

India

The current market exhibits a positive trajectory, rendering it a judicious selection for sellers in the present circumstances.

• The current market conditions remain favorable and exhibit consistent growth, with local markets also demonstrating positive performance.

• Buyers have a strong inclination towards making purchases in this particular market, which is characterized by a notable absence of issues related to LCs. Consequently, this market has emerged as a very secure and reliable destination for sellers seeking to sell their assets in the present day.

• It competes at the same level as Pakistan, and another advantage is that green recycling is available at the same price as traditional recycling in India, a difference of at least 20 to 30 USD on the market.

• The growth projection for the domestic steel industry in the current fiscal year has been revised upwards to a range of 9-10 percent. The growth prospects of the steel industry, which were initially estimated at 7-8 percent, have experienced a positive shift as a result of robust government expenditure on infrastructure.

Beaching Dates

15 September to 20 September 2023

26 September to 30 September 2023

01 October to 05 October 2023

Ship recycling reports suggest that there would be sufficient capacity in India

Bangladesh

The market is currently experiencing a state of muted activity with long-standing LC issues.

• The current market conditions persist in a state of subdued activity, characterized by a lack of interest and engagement from potential buyers.

• The decline of local markets has presented significant challenges for buyers, exacerbating their difficulties.

• The current market conditions are expected to remain subdued for a minimum of one month unless a satisfactory resolution to the LC problem is achieved or there is a significant improvement in the local market.

• The Bangladesh Bank (BB) relaxed the settlement conditions for finances obtained from the Export Facilitation Pre-finance Fund (EFPF). The EFPF funds are subject to one-time repayment with interest at the conclusion of the period. The central bank eased this requirement after businesspeople advocated for a partial payment option to minimize the fund’s interest cost. EFPF will now be allowed to pay some or all of the money before the period expires if the bank so desires.

Beaching Dates

15 September to 17 September 2023 28 September to 01 October 2023 13 October to 16 October 2023

Pakistan

The market displays a moderate level of interest from buyers with restricted availability of LCs.

• In the present market, there exists a moderate level of purchasing interest; however, it is important to note that this interest is relatively limited. Furthermore, the persistent issue of LC complications continues to persist. As a result of LC constraints, buyers are exercising selectivity in their asset preferences, submitting favorable bids exclusively for those assets. Conversely, a lack of offers is observed for other assets.

• The optimal range for assets under consideration in this context lies within the interval of 7,000 to 10,000 LDT. Assets falling outside this range are not being considered or given much thought.

• The government has implemented a stringent regulatory measure to address the issue of currency exchange conducted by unauthorized individuals in the open market and stricter measures to combat smuggling activities originating from Iran and Afghanistan, leading to a reduction in the illicit transportation of steel products from Iran to Pakistan. The strengthening of the currency has prompted buyers of ship plates to hold out to see if this will result in a price decline.

Beaching Dates

Throughout the month

Ship recycling market facing challenges

Türkiye

The market exhibits stability, characterized by a modest increase in activity.

• The market demonstrates a state of stability in both the domestic and import sectors.

• There appears to be a noticeable uptick in activity, however, it is yet to display any discernible impact on prices.

• The Central Bank of the Republic of Türkiye (CBRT) recently implemented a significant adjustment in its monetary policy by increasing the compulsory reserve ratio for FX- protected deposits, commonly referred to as KKM, from 15% to 25%. This decision is part of a broader set of measures aimed at gradually relaxing the lira-protection scheme that was introduced in 2021.

• The exports of Türkiye’s hot rolled coil (HRC) experienced a significant decline of 40.1 percent during the January to July period of the current year, in comparison to the corresponding period in 2022. Additionally, the value of these exports also witnessed a substantial decrease of 53.4 percent during the same timeframe.

Beaching Dates

Throughout the month.