Ship Recycling: Demand and Tonnage remained notable Low in India: BEST OASIS

Leading cash buyer for the ships sending for recycling BEST OASIS in their weekly ship recycling report opined that this week, the ship recycling markets across South Asia and Türkiye remained subdued, continuing the cautious tone seen in recent weeks. In India, the market saw no significant change as demand and tonnage remained notably low. Ship-recycled steel continued to struggle against the appeal of hot rolled coil plates, which, despite being priced slightly higher, are preferred for their superior quality and consistency. This, combined with ample domestic production and steady imports, further weighed on the market. Bangladesh mirrored this sluggish trend, with negligible activity and no significant developments, despite fleeting hopes of a year-end boost or support from the interim government. Pakistan continued its prolonged stagnation due to constrained financial access and difficulties in opening letters of credit, leaving the market directionless. Türkiye experienced a USD 10 drop in import prices, but local market conditions showed little response, reflecting persistent weak sentiment and demand. We can say that the markets largely remained cautious and stagnant, weighed down by low demand, financial constraints, and competitive pressures from alternative steel sources, with no immediate signs of recovery on the horizon.

Global steel production in October 2024 grew by 0.4% year-on-year and 5.3% month-on-month, reflecting recovery driven by steady outputs in China and India and strong gains in Germany and Brazil, despite declines in South Korea and Russia. With demand projected to rise 1.7% in 2024 to 1.793 billion metric tons, fueled by infrastructure and industrial expansion in developing regions, the industry faces a delicate balancing act. If production outpaces demand, overcapacity could become a looming challenge, potentially weighing down prices and margins. The question now is whether producers can strike the right balance to ensure sustainable growth.

India

Market sluggishness continues amid low demand and competitive steel imports.

There was no significant change in the market this week, with demand and tonnage remaining notably low.

The demand for ship steel continues to be minimal, and one possible reason might be its reduced competitiveness in the market. For instance, hot-rolled coil (HRC) plates, known for their superior quality and consistency, are priced in a comparable range as the re-rolling plates (11–12 mm). This makes new steel a more attractive choice for buyers. This, combined with sufficient domestic production and cheaper steel imports from China, has further weakened the demand for ship-recycled steel.

Overall, these factors together could explain why the market remains sluggish, as there is limited demand and no significant drivers to boost activity in the sector.

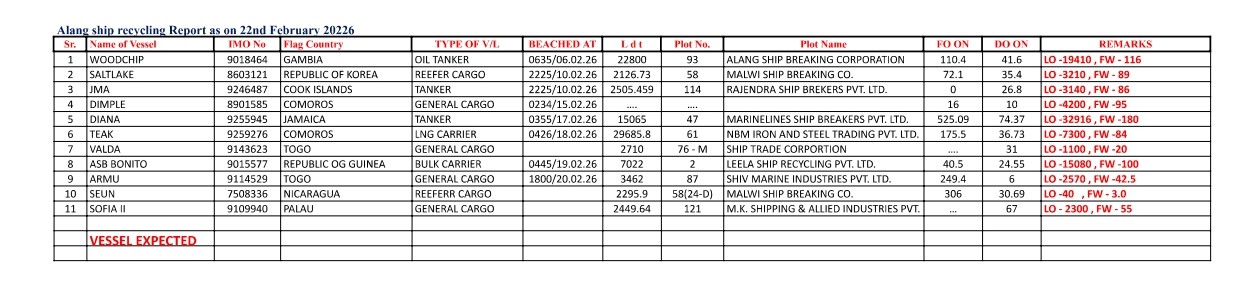

Beaching Dates

29 November to 07 December 2024

12 December to 20 December 2024

Bangladesh

Price for Recycling Ships in Bangladesh The market remains stagnant with limited activity and no clear

improvements.

The market remained largely stagnant, mirroring the lack of activity seen in the previous weeks. While there was a brief uptick in the local market, this momentum quickly fizzled out and has since been on a declining trajectory.

There were no notable changes in the vessel bookings, with activity remaining flat. Only three LNG carriers were sold in this market, with only three LNG carriers sold, reflecting the ongoing subdued trend. The year-end factor might still bring some minor activity, but so far, there are no clear indicators of significant improvement.

The interim government, which was expected to bring about some positive developments, seems to have had little to no impact on the market dynamics.

Beaching Dates

30 November to 03 December

14 December to 17 December

Pakistan

The price for Recycling Ships in Pakistan Market remains unchanged amid persistent economic challenges and funding issues.

The market remains the same as last week, stuck in a long period of stagnation. The industry continues to face challenges like trouble opening letters of credit (LCs) and limited access to funds due to the tough economic situation.

Pakistan Steel Mills (PSM) has been directed by the National Assembly’s Industries Committee to expedite its revival and address urgent issues, including unpaid dues to former employees, utility disruptions, and the deteriorating condition of the Steel Hospital. Utility providers and PSM management were instructed to prioritize these matters and submit a compliance report without delay.

The IMF recently held talks with Pakistan to address economic vulnerabilities under its USD 7 billion bailout program. Discussions focused on revenue shortfalls, external financing gaps, and setbacks in privatizing state-owned enterprises. Structural reforms in the loss-making power and gas sectors were highlighted, with both sides emphasizing prudent policies and expanding the tax base for sustainable growth.

Beaching Dates

Throughout the month

Türkiye

Price for Recycling Ships in Türkiye The market experiences a drop, leaving the domestic impact yet to be determined.

The market experienced a USD 10 drop in import prices this week, though the impact on the local market has yet to be observed.

Turkey’s central bank kept its policy rate at 50%, highlighting the need for tight monetary conditions to support its disinflation goals based on both current and expected inflation. Analysts viewed this as a signal for a potential rate cut shortly.

Beaching Dates Throughout the month

Author: shipping inbox

shipping and maritime related web portal