Ship Recycling Caught in Crossfire of Global Turmoil

This week, the world stands on the precipice of heightened tensions and economic instability as a series of dramatic events have unfolded across various regions, raising alarms and reshaping geopolitical and economic landscapes. From the looming threat of conflict in the Middle East to the abrupt resignation of a prominent leader in South Asia, the global community is grappling with a wave of uncertainty that has left nations, industries, and markets in a state of flux.

Middle East on High Alert: Iranian/Hezbollah Threats Loom Large

The most pressing concern this week has been the escalating security situation in the Middle East. Reports indicate an imminent threat from Iran and Hezbollah against Israel, which has prompted swift and decisive action from the United States. In a move that underscores the gravity of the situation, the U.S. has repositioned two aircraft carrier strike groups—along with their accompanying destroyer fleets—off the coast of the Gulf of Oman and the Eastern Mediterranean. This manoeuvre is a clear signal of the U.S. commitment to safeguarding its allies and deterring potential aggression in the region.

The deployment of these naval assets has placed the entire region on high alert. Israel, in particular, has ramped up its security measures, with intelligence agencies working around the clock to monitor and intercept any potential threats. The presence of U.S. military power in such strategic locations is seen as both a deterrent and a precautionary measure, designed to prevent any escalation of hostilities that could have far-reaching consequences.

The situation is reminiscent of previous periods of heightened tension in the Middle East, where the specter of conflict has loomed large over the region. However, the current scenario is compounded by the complex web of alliances and rivalries that define the geopolitical landscape. Iran’s support for Hezbollah, coupled with its broader ambitions in the region, has long been a source of concern for Israel and its allies. The recent developments suggest that these concerns are now closer to becoming a reality.

As the world watches anxiously, diplomatic efforts are underway to de-escalate the situation. However, the possibility of a miscalculation or an unprovoked attack remains a constant threat. The coming days will be critical in determining whether the region can avoid a descent into conflict or if the world will witness yet another chapter in the long and tumultuous history of the Middle East.

Political Turmoil in Bangladesh: PM Sheikh Hasina’s Abrupt Resignation

While the Middle East grapples with the threat of war, South Asia has been shaken by an unexpected political upheaval. In a move that has stunned the nation, Bangladesh’s Prime Minister Sheikh Hasina abruptly resigned from her position and fled to India in a government helicopter. The resignation of one of the region’s most prominent political figures has triggered a wave of speculation and uncertainty, both within Bangladesh and beyond its borders.

Sheikh Hasina’s sudden departure comes at a time of increasing domestic unrest. Over the past few months, Bangladesh has witnessed growing protests and demonstrations, fueled by widespread dissatisfaction with the government’s handling of various issues, including economic challenges and allegations of corruption. The situation reached a boiling point in July, with violent clashes between protesters and security forces becoming a regular occurrence.

The resignation of Hasina, who had been in power for over a decade, marks the end of an era in Bangladeshi politics. Her tenure was characterized by a mix of economic progress and authoritarian tendencies, with critics accusing her government of stifling dissent and undermining democratic institutions. Despite these criticisms, Hasina maintained a firm grip on power, making her sudden exit all the more surprising.

In the wake of her resignation, Bangladesh has been thrown into a state of political uncertainty. The absence of a clear successor has created a power vacuum, with various factions vying for control. Meanwhile, the public’s reaction has been mixed. While some have celebrated the departure of a leader they viewed as out of touch with the needs of the people, others are concerned about the potential for further instability and unrest.

The impact of Hasina’s resignation is already being felt beyond Bangladesh’s borders. India, which has been a close ally of Hasina’s government, is closely monitoring the situation. The fact that she sought refuge in India adds another layer of complexity to the situation, raising questions about the future of India-Bangladesh relations and the broader regional dynamics.

Economic Repercussions: Steel Prices and Ship Recycling in Turmoil

The political and security developments in the Middle East and South Asia have also had significant economic repercussions, particularly in the ship recycling industry. The resignation of Sheikh Hasina has coincided with a sharp decline in Indian steel prices, a development that has sent shockwaves through the global market.

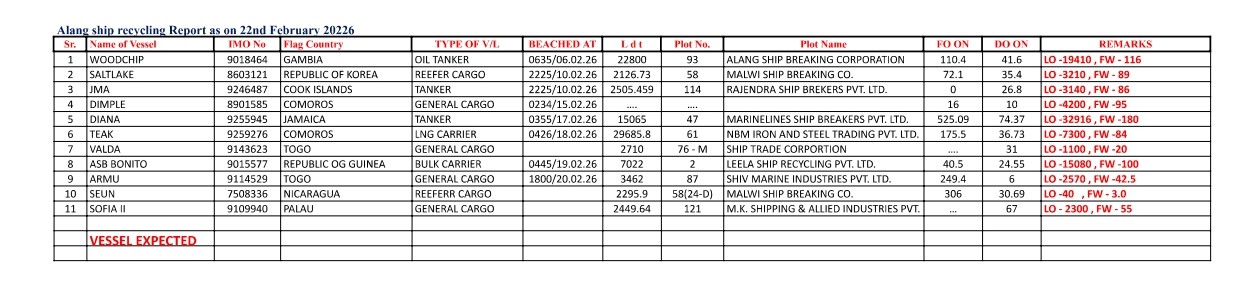

In recent weeks, steel prices in India have nosedived, leading to a domino effect across the ship recycling nations. The currencies of these countries, including Bangladesh, Pakistan, and Turkey, have devalued in unison against the U.S. dollar, exacerbating the challenges faced by the industry. The collapse in steel prices has been particularly pronounced in Alang, one of the world’s largest ship recycling hubs, where offers on dry bulk units have fallen below USD 500/LDT (light displacement tonnage), a significant drop from previous levels.

The situation has been further complicated by the lack of fresh tonnage arriving at Pakistan’s waterfront, despite the country having some of the firmest prices on offer. This has left Pakistan’s ship recycling industry in a precarious position, struggling to secure business even as other nations report some degree of activity.

India’s steel industry has been hit hard by the unexpected results of the recently concluded General Elections, which have led to a collapse in local steel plate prices. Despite a budget that was seen as positive for the nation, the ship recycling industry in Alang has been mired in gloom for over six weeks. The downturn in demand and pricing has left many yards lying dormant, further exacerbating the industry’s woes.

Adding to the industry’s challenges is the increasing competition from Bangladesh, where four new HKC (Hong Kong Convention) compliant yards have been recognized. This development threatens to divert the limited supply of HKC units away from Alang, further diminishing the prospects for India’s ship recycling sector. The situation in Bangladesh, however, remains volatile, with the country’s ongoing economic struggles and a lack of U.S. dollars posing significant risks to its ship recycling industry.

Pakistan, meanwhile, continues to occupy a unique position in the market. Despite having some of the firmest prices, the country has been relatively passive in capturing the full potential of its position. This has led to a situation where Pakistan remains a dark horse in the industry, with the potential to disrupt the market if it can fully capitalize on its advantages.

Turkey, on the other hand, is grappling with its challenges. The country’s ship recycling industry has been notably silent, with levels finally falling by USD 15/ton. This development has added to the sense of uncertainty in the global ship recycling market, with many industry players calling for a reset in the face of the current turmoil.

A Call for Stability: The Path Forward

As the world navigates through these turbulent times, there is a growing recognition of the need for stability—both in terms of global peace and economic resilience. The ship recycling industry, in particular, is in desperate need of a return to stability, as the current environment of uncertainty and volatility threatens to undermine its long-term viability.

The recent events in the Middle East, South Asia, and the global market have highlighted the interconnectedness of geopolitical and economic factors. The threat of conflict, political upheaval, and market instability are all intertwined, creating a complex web of challenges that require careful management and coordinated responses.

For the ship recycling industry, the road to recovery will depend on some factors. First and foremost, a resolution to the political and security crises in key regions will be essential in restoring confidence and encouraging investment. The ability of countries like India, Bangladesh, and Pakistan to stabilize their economies and currency values will also play a critical role in determining the industry’s future trajectory.

Moreover, the industry itself will need to adapt to the changing landscape, particularly in terms of compliance with international standards and the ability to compete on a global scale. The rise of HKC-compliant yards in Bangladesh is a reminder of the importance of adhering to global best practices, even as competition intensifies.

In the broader context, the world must come together to address the underlying issues that have contributed to the current state of affairs. Whether through diplomatic efforts to de-escalate tensions in the Middle East, or through economic policies aimed at stabilizing markets and supporting vulnerable industries, the need for collective action has never been greater.

As we look ahead, it is clear that the challenges facing the global community are daunting. However, with the right strategies and a commitment to cooperation, there is hope that stability can be restored, paving the way for a more secure and prosperous future. For the ship recycling industry, and for the world at large, this moment of crisis also presents an opportunity—to rebuild, to innovate, and to create a more resilient and sustainable global economy.

Author: shipping inbox

shipping and maritime related web portal