Positivity Emerges in Ship Recycling Amid Baltic Index Decline and Global Economic Uncertainties

In an unusual twist, the ship recycling market is witnessing a wave of optimism amid challenging conditions in the global shipping and steel markets. The recent drop in the Baltic Dry Index (BDI) to its lowest point this year marks the ninth consecutive week of decline for this key sea freight measure. This downturn has rippled through global ship recycling markets, with a sharp focus on older trading fleets that are now being redirected to recycling facilities rather than maintaining their operations.

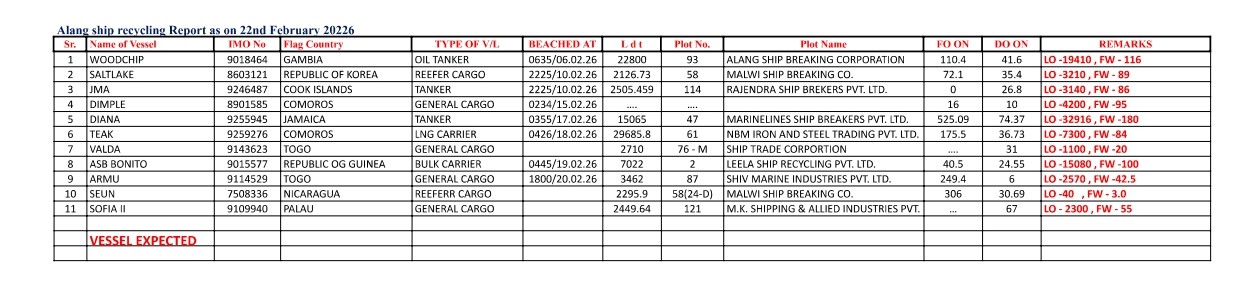

Global Maritime Services (GMS), a prominent cash buyer in the ship recycling market, has noted the impact of these trends on various recycling destinations. As GMS reported this week, the decline in the BDI is driving increased imports across recycling markets, including a notable resurgence from Pakistan after a period of relative dormancy. However, broader economic challenges continue to cast a shadow over the sector, with GMS highlighting factors such as the recent drop in steel plate prices in key recycling hubs like Bangladesh and India, likely in response to declining steel prices in China last week.

Economic and Geopolitical Pressures Mount

In addition to market-specific pressures, the ship recycling industry is facing external economic uncertainties fueled by recent global developments. One major area of interest this week is the BRICS summit taking place in Russia, where member countries, including Brazil, Russia, India, China, and South Africa, are exploring options for creating a common currency to challenge the dominance of the U.S. dollar in international trade. While this initiative remains largely aspirational at this point, it reflects a shift in sentiment within some of the world’s largest economies towards reducing dependency on dollar reserves.

However, such a shift would be far from simple. The International Monetary Fund (IMF) is primarily funded by the United States, and for nations heavily reliant on IMF funding or on dollar-based reserves, this economic restructuring poses significant risks. In terms of ship recycling markets, currency fluctuations in recycling hubs have added further challenges. Turkey’s lira and other regional currencies have been struggling, while the Chinese yuan remains under pressure as the U.S. dollar gained 24 basis points against the CNY this week.

Bangladesh and India Face Stiff Challenges

In South Asia, a key hub for shipbreaking, the recycling industry is grappling with additional pressures beyond the BDI decline. Bangladesh has traditionally been a strong competitor in this sector but has struggled to match India’s pricing on geographically favorable vessels. Recently, Bangladesh has displayed some promising signs, with a handful of recyclers indicating interest in transactions. However, falling steel plate prices have eroded the competitive edge that Bangladeshi yards once held.

India, which remains a significant player, has experienced similar struggles with steel prices. In both countries, recyclers are operating within tighter margins, limiting their ability to aggressively pursue tonnage. As a result, the price offers for ships heading to recycling yards have fallen below the USD 500 per long ton (LDT) threshold, which traditionally served as a benchmark for profitability in this sector. Even container units, which typically fetch higher prices, are unable to cross this mark, signaling a broad downturn across ship types.

Pakistan’s Return and Uncertain Future

For Pakistan, this week marked a significant moment as the country welcomed a high LDT vessel to its Gadani recycling yard, a rare event given the market’s prolonged dormancy. Pakistan’s ship recycling industry has faced substantial challenges in recent years, including economic instability and fluctuating steel demand, which have hampered its ability to compete with Bangladesh and India.

Despite this recent boost, GMS warns that Pakistan may return to its quiet phase soon as the broader economic environment continues to weigh on the industry. For Pakistani recyclers, maintaining consistent levels of activity remains challenging, with currency volatility and low steel demand constraining their options.

Turkey’s Ship Recycling Industry Faces a Slump

Meanwhile, Turkey’s ship recycling sector has been dealing with a slow but steady decline in activity. Turkish recyclers have been witnessing weakening demand and anticipate further drops in prices, which could see values approach USD 450 per LDT in the coming weeks. The Turkish market, which typically operates at a different price range compared to South Asia, has also been affected by global steel price declines and local currency devaluation. These conditions suggest a difficult path ahead for Turkish recyclers, who had been hoping for a rebound in prices but now appear braced for further declines.

Outlook for the Remainder of 2024

Looking ahead, market analysts are pessimistic about a quick recovery in ship recycling prices. With the BDI reaching new lows and steel prices under sustained pressure, the ship recycling sector appears set to endure a challenging period for the rest of the year. While there is a degree of optimism due to increased recycling imports, particularly from older vessels, recyclers remain cautious given the ongoing economic uncertainties and steel price volatility.

Despite recent activity in Pakistan and some interest from Bangladeshi recyclers, the market remains volatile, with prices unlikely to hit the USD 500/LDT mark that once seemed achievable. Turkish recyclers, too, are preparing for potential price slumps, further contributing to the industry’s overall sense of caution.

As recyclers worldwide continue to navigate these turbulent waters, a sustained focus on economic and currency conditions, alongside steel market trends, will be essential in determining the trajectory of the ship recycling market. While some areas have seen renewed activity, the broader outlook for ship recyclers appears dim, with cautious optimism and strategic patience becoming the guiding principles as they face the remainder of 2024.

Author: shipping inbox

shipping and maritime related web portal