India’s Ship Recycling Industry Sees Significant Growth Amidst Global Decline

Mumbai: India’s ship recycling industry, a crucial player in the global maritime sector, is set for major growth, according to a report by CareEdge. In 2023, India’s share of the global ship recycling market rose to 33%, up from 27% in previous years, making it the second-largest ship recycler globally, only behind Bangladesh, which accounts for 46%. As newer, more efficient vessels replace aging ones, the demand for ship recycling is increasing, offering India an opportunity to expand its already significant role in this sector.

The ship recycling industry in India is poised to dismantle between 2.3 and 2.6 million gross tonnage (GT) in 2024. By 2025, this number is projected to grow to 3.8-4.2 million GT, driven by several key factors. These include the increased availability of obsolete ships, stable steel scrap prices, and the introduction of greener, more efficient vessels into the global fleet.

Factors Contributing to Growth

The maritime industry is currently undergoing a major shift as older vessels become unviable for operation. This change is largely driven by advancements in ship technology, which make newer vessels far more efficient and cost-effective. As a result, ship operators are retiring aging vessels that are no longer economical to maintain, creating a growing need for ship recycling.

India’s ship recycling industry benefits from several favorable conditions. According to Sajani Shah, Assistant Director at CareEdge, “The cooling-off of the Baltic Dry Index, the stabilization of heavy melting scrap prices, and an increase in obsolete ships in operation suggest that more vessels will enter the recycling market from 2025 onwards.” This anticipated increase in recycling activity aligns with India’s strong presence in the global market, where it dismantled 2.26 million GT in 2022 and 2.47 million GT in 2023.

India’s recycling facilities are also supported by a favorable financial structure. The ship recycling industry in the country operates with low debt levels, low fixed overheads, and relies on contract-based employees. These factors make the industry more resilient to economic fluctuations, allowing it to remain competitive on the global stage. As a result, the convergence of stable freight rates and the increased availability of aging ships suggests that India is well-positioned to handle growing demand in the coming years.

Green Recycling and Infrastructure Development

The report from CareEdge highlights the importance of green recycling facilities and modern infrastructure in attracting a larger portion of ships for dismantling. As global environmental standards become stricter, ship recyclers will need to adopt greener, more sustainable practices to remain competitive. India has already made strides in this direction, and countries with better infrastructure and environmentally-friendly practices are expected to dominate the industry in the future.

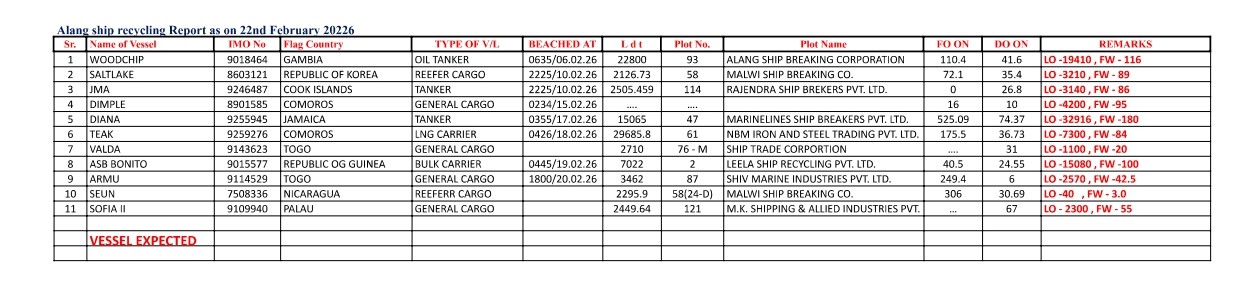

The Indian government has recognized the importance of these advancements and has been working to improve the country’s ship recycling infrastructure. The Alang shipyard in Gujarat, the largest ship recycling yard in the world, has made significant progress in adopting green recycling practices. It has also implemented safety measures to protect workers, which has helped enhance the reputation of India’s ship recycling industry on the global stage.

Impact of Heavy Melting Scrap Prices

One of the key challenges that the industry faced in recent years was the fluctuating price of heavy melting scrap. In 2020, prices for heavy melting scrap in Bhavnagar, Gujarat, were around Rs 28,800 per tonne. However, by April 2022, these prices surged to Rs 54,400 per tonne due to supply chain disruptions and increased demand for steel in the post-pandemic economic recovery.

This sharp increase in scrap prices put pressure on the ship recycling industry, leading to a slowdown in activity in FY23 and FY24. However, after reaching its peak, the market began to stabilize. By December 2023, scrap prices had fallen to Rs 39,900 per tonne, and since the start of 2024, they have remained between Rs 36,000 and Rs 44,000 per tonne.

This stabilization is a positive development for India’s ship recycling industry, providing a more predictable cost structure for operators. With scrap prices no longer fluctuating as dramatically, recyclers can better plan their operations, which is expected to lead to a resurgence in activity from 2024 onwards.

Global Declines and India’s Opportunity

While India’s ship recycling industry has seen consistent growth, global ship recycling activities have faced a decline in recent years. This decline, combined with a stable increase in global shipping capacity, has resulted in a growing number of obsolete vessels still in operation. These older ships will need to be dismantled, creating an opportunity for countries like India to expand their role in the market.

Bangladesh remains the leader in global ship recycling, handling 46% of the total volume. However, India’s 33% share of the market reflects its growing importance in the industry. The other major players in the global ship recycling sector include Pakistan and Turkey, with the top four countries (Bangladesh, India, Pakistan, and Turkey) dismantling over 90% of the world’s ships.

Future Prospects

The ship recycling industry in India is expected to grow at a compound annual growth rate of around 10% between 2026 and 2028. This growth will be driven by several factors, including the introduction of newer ships, the cooling off of the Baltic Dry Index, and the stabilization of scrap prices. Additionally, the aging global fleet means that more ships will be retired in the coming years, creating further opportunities for India’s ship recycling industry to expand.

According to CareEdge, the ship recycling sector will experience steady growth in 2024, with an estimated 2.3 to 2.6 million GT dismantled. By 2025, this number is expected to jump to over 3.8 to 4.2 million GT, driven by the availability of more obsolete ships and stable market conditions.

India’s ship recycling industry has a crucial role to play in the global maritime sector, and its future looks bright. With favorable market conditions, modern infrastructure, and a focus on sustainable practices, the country is well-positioned to capitalize on the rising demand for ship recycling in the years to come. As the world moves towards greener and more efficient vessels, India’s contribution to the global recycling market will continue to grow, solidifying its position as a major player in the industry.

Author: shipping inbox

shipping and maritime related web portal