Ship Recycling: End Buyers hesitate to commit to purchases: STAR ASIA

The recycling market continues to suffer pointed volatility as end buyers across major destinations hesitate to commit to purchases. Despite brief price spikes in both Bangladesh and Pakistan, these markets quickly reverted to their wary approach, primarily resulting from ongoing L/Cs restrictions that have severely limited buying capabilities.

The recent U.S. Treasury Department sanctions against the dark fleet VLCC Itaugua, has sent ripples through the industry, deterring buyers who had been eyeing dark fleet prospects. The situation has become particularly sensitive as both the Itaugua and another vessel, the Artemis III, were on watchlists published by United Against Nuclear Iran and the U.S. Department of Energy for allegedly transporting sanctioned Iranian crude oil, despite not being formally sanctioned at the time of their arrival in Bangladesh.

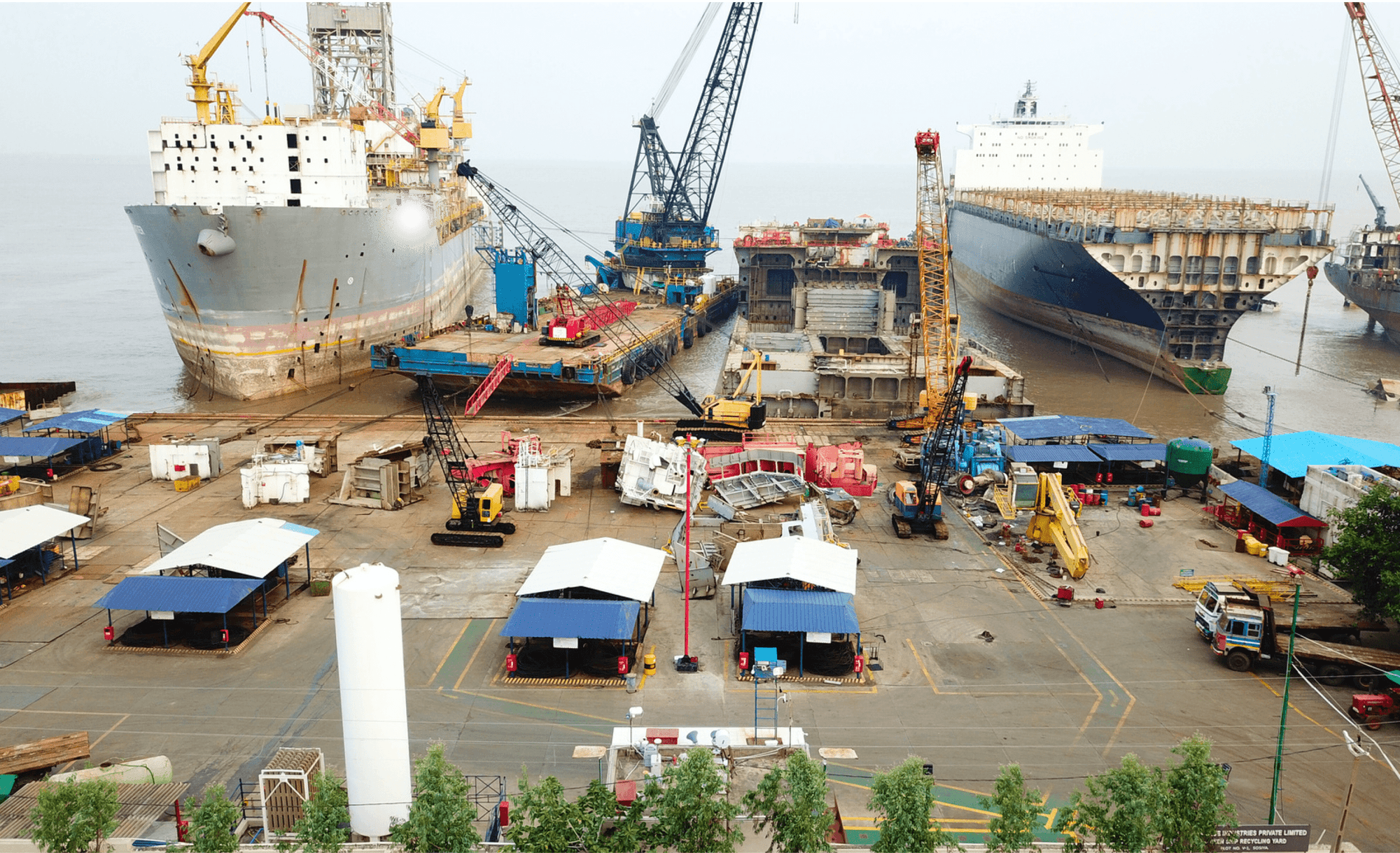

Alang, India

Alang’s sector continues to face challenges despite broader economic improvements. Local sentiment remains weak following a poor month marked by declining vessel offers and diminishing tonnage supply. With reluctant buyers and a small price correction, the outlook has failed to inject confidence.

Adding to these concerns, India’s steel export outlook is darkening due to proposed European Commission safeguard adjustments. The new quota caps would significantly reduce India’s hot rolled coil allocation by nearly 24% between April and June compared to the previous quarter, with similar reductions planned for cold rolled coil, plate, and galvanized products. Industry sources warn these export restrictions could destabilize the domestic market by creating an oversupply situation, further thwarting recovery prospects for the sector.

Anchorage & Beaching Position (MARCH 2025)

| VESSEL NAME | TYPE | LDT | ARRIVAL | BEACHING |

| HESEN M | GENERAL CARGO | 2,240 | 08.03.2025 | AWAITING |

| AK HAMBURG | GENERAL CARGO | 2,616 | 28.02.2025 | 11.03.2025 |

| KALINA | GENERAL CARGO | 5,150 | 02.03.2025 | 06.03.2025 |

| ELAN | TANKER | 13,394 | 02.03.2025 | 05.03.2025 |

| ATHINA I | TANKER | 14,883 | 28.02.2025 | 04.03.2025 |

| IRIS OF SEA | RORO | 2,783 | 26.02.2025 | 03.03.2025 |

| TALENT BLUE | BULKER | 3,589 | 21.02.2025 | 01.03.2025 |

Chattogram, Bangladesh

Bangladesh’s outlook remains hesitant, with buyers strategically shifting their focus to smaller vessels amid reduced tonnage availability. Despite good demand, financial uncertainty and severely limited L/Cs availability have forced recyclers to adopt a cautious, selective approach to purchases. This situation coincides with the local scrap market experiencing modest improvement following a subdued start to Ramadan, with imported scrap offers declining by US$5-7 per ton while overall buying remains weak.

Looking toward future developments, Bangladesh’s steel industry is poised for transformation with Bashundhara Multi Steel Industries’ planned facility at the National Special Economic Zone in Mirsarai, Chattogram. Set to begin operations by mid-2026, this project will feature the world’s largest single-strand mini mill for long steel products,

with a 1.25 million tons per year capacity for rebar in coil and wire rod production. With over half the site already developed and plans for a dedicated jetty on the Sandwip Channel, this advancement may eventually provide new opportunities for the region.

Anchorage & Beaching Position (MARCH 2025)

| VESSEL NAME | TYPE | LDT | ARRIVAL | BEACHING |

| SUNGHO | GENERAL CARO | 2,345 | 13.03.2024 | AWAITING |

| BEST UNITY | BULKER | 9,826 | 13.03.2024 | AWAITING |

| TASOS | BULKER | 10,738 | 11.03.2024 | AWAITING |

| RUN FU 7 | BULKER | 6,977 | 10.03.2024 | AWAITING |

| TRADER III | LNG | 29,101 | 10.03.2024 | AWAITING |

| THREE STAR | BULKER | 7,627 | 23.01.2025 | AWAITING |

| GENERALIS | GENERAL CARGO | 3,311 | 14.02.2025 | 12.03.2024 |

| BANGLAR JYOTI | TANKER | 3,787 | – | 11.03.2024 |

| BANGLAR SHOURAV | TANKER | 3,740 | – | 10.03.2024 |

Gadani, Pakistan

Gadani is showing signs of life despite broader challenges in the local steel market. Despite these indicators, the sector continues to face considerable financial constraints that limit its growth potential. Ongoing restrictions on L/Cs mean only a few buyers can secure financing for larger vessels, potentially hindering deals for more substantial tonnage.

This financial challenge is further reflected in the recent US$152 million decrease in foreign exchange reserves held by the State Bank of Pakistan, which fell to US$11 billion due to external debt repayments, even as the central bank engaged in large-scale dollar purchases from the banking market to mitigate these pressures.

Anchorage & Beaching Position (MARCH 2025)

| VESSEL NAME | TYPE | LDT | ARRIVAL | BEACHING |

| – | – | – | – | – |

Aliaga, Turkey

Turkish recycling sector saw positive momentum as domestic scrap prices continued to rise in alignment with higher imported scrap values. Despite this gain, mills are facing resistance in the international market, finding suppliers’ offers for imported scrap largely unaffordable given current poor steel sales performance.

Outlook at the moment remains uncertain with no clear direction.

| BUNKER PRICES (USD/ton) | |||

| PORTS | VLSFO (0.5%) | HSFO (3.5%) | MGO (0.1%) |

| SINGAPORE | 504 | 458 | 640 |

| HONG KONG | 516 | 475 | 653 |

| FUJAIRAH | 507 | 457 | 743 |

| ROTTERDAM | 500 | 433 | 637 |

| HOUSTON | 523 | 437 | 686 |

| EXCHANGE RATES | |||

| CURRENCY | March 14 | March 7 | W-O-W % CHANGE |

| USD / CNY (CHINA) | 7.23 | 7.23 | 0 |

| USD / BDT (BANGLADESH) | 121.49 | 121.42 | -0.06% |

| USD / INR (INDIA) | 86.90 | 87.13 | +0.26% |

| USD / PKR (PAKISTAN) | 279.92 | 279.96 | +0.01% |

| USD / TRY (TURKEY) | 36.52 | 36.46 | -0.16% |

Ship Recycling Market Snapshot

| DESTINATION | TANKERS | BULKERS | MPP/ GENERAL CARGO | CONTAINERS | SENTIMENTS / WEEKLY FUTURE

TREND |

|

ALANG (WC INDIA) . |

450 ~ 460 |

430 ~ 440 |

440 ~ 450 |

460 ~ 470 |

STABLE / |

|

CHATTOGRAM, BANGLADESH |

460 ~ 470 |

450 ~ 460 |

440 ~ 450 |

470 ~ 480 |

STABLE / |

|

GADDANI, PAKISTAN |

440 ~ 450 |

420 ~ 430 |

420 ~ 430 |

460 ~ 470 |

STABLE / |

| TURKEY

*For non-EU ships. For E.U. Ship, the prices are about USD 20-30/ton less |

320 ~ 330 |

300 ~ 310 |

290 ~ 300 |

330 ~ 340 |

STABLE / |

- All prices are USD per light displacement tonnage in the long

- The prices reported are net prices offered by the recycling

- Prices quoted are basis simple Japanese / Korean-built tonnages trading Premiums are paid on top of the above-quoted prices based on quality & quality of Spares, Non-Fe., bunkers, cargo history, and maintenance.

5-Year Ship Recycling Average Historical Prices (Week 11)

| DESTINATION | 2020 | 2021 | 2022 | 2023 | 2024 |

| ALANG, INDIA | 380 | 430 | 660 | 550 | 490 |

| CHATTOGRAM, BANGLADESH | 370 | 450 | 680 | 590 | 540 |

| GADDANI, PAKISTAN | 360 | 460 | 650 | – | 540 |

| ALIAGA, TURKEY | 230 | 250 | 380 | 320 | 330 |

Ships Sold for Recycling

| VESSEL NAME | LDT | YEAR / BUILT | TYPE | PRICE

(USD/LDT LT) |

COMMENTS |

| TRADER III | 29,101 | 2002 / JAPAN | LNG | 496 | DELIVERED CHATTOGRAM |

| RUN FU 6 | 6,297 | 1995 / JAPAN | BULKER | 435 | DELIVERED SUB-CONTINENT |

| SEAWORLD

MARINE |

5,541 | 1997 / JAPAN | RORO | 396 | AS IS MOKPO,SOUTH KOREA |

| HESEN M | 2,240 | 1986 / TURKEY | GENERAL

CARGO |

UNDISCLOSED | DELIVERED ALANG |

| SUNNY LINDEN | 2,216 | 1995 / S.KOREA | CONTAINER | UNDISCLOSED | AS IS SOUTH KOREA |

Commodities (Week in focus)

Iron ore markets showed mixed signals at closing as seaborne prices weakened while futures demonstrated strong performance. Singapore Exchange April contracts for 62% Fe gained US$1.56 to reach US$102.22 per ton, suggesting divergent short-term and mid-term outlooks. Industrial metals, including Copper and Aluminium, also saw decline at the week’s closing.

Recent inventory data has reinforced signs of improving demand in China, with apparent consumption of major steel products increasing and total steel inventories continuing to decline. Notably, rebar inventories maintained their downward trend despite rising production levels, signalling steady demand in the construction sector. This positive indicator has helped restore some confidence in the market, alleviating concerns over the potential oversupply that had previously weighed on sentiment.

In related news, Canada has filed an additional complaint with the World Trade Organization against the United States, specifically targeting President Trump’s recently implemented 25% tariffs on steel and aluminium imports. This petition follows an earlier objection to Trump’s blanket tariff on Canadian imports and comes alongside retaliatory measures on approximately CAD 30 billion (US$20.8 billion) of US goods. The Canadian Steel Producers Association has expressed alarm over these “unjustified” tariffs, warning of “devastating repercussions on both sides of the border” and calling on the Canadian government to enact protective measures against unfair trade practices while prioritizing domestic steel in publicly funded infrastructure projects.

Author: shipping inbox

shipping and maritime related web portal